stock market bubble definition

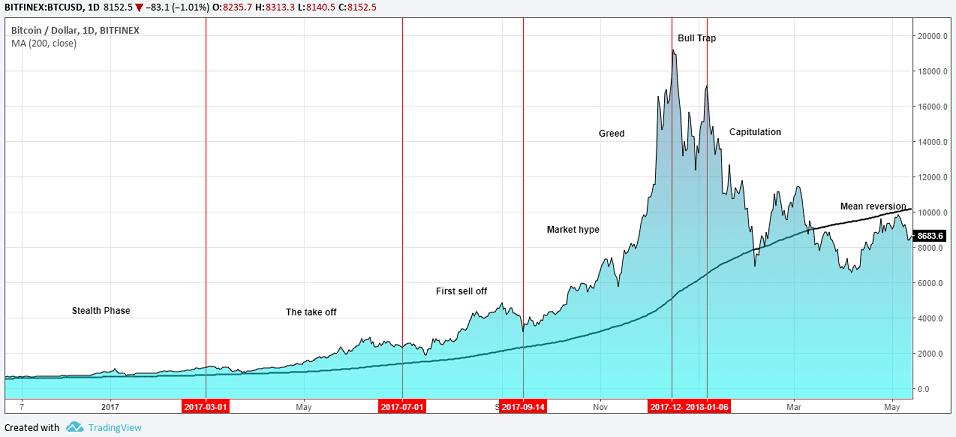

Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. An economic bubble is a situation in which asset prices are much higher than the underlying fundamentals can reasonably justify.

How The U S Stock Market May Be Turning Japanese Seeking Alpha

A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value.

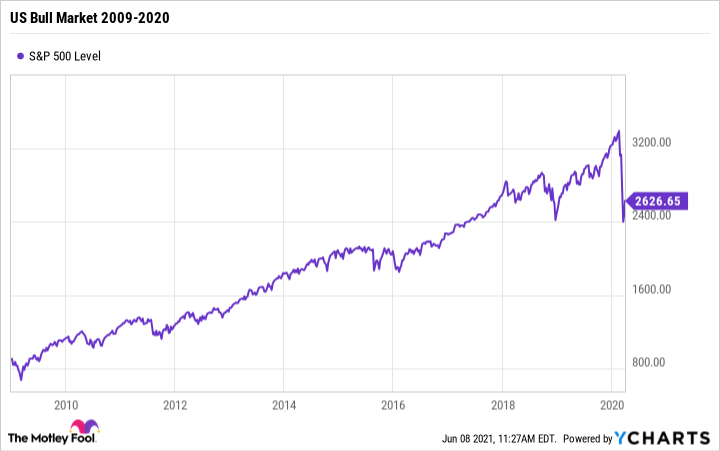

. A stock market bubble is a period of growth in stock prices followed by a fall. Rising lumber prices have been everyones favourite example of what results from clogged pandemic supply chains and the booming post-virus economy. As you will read there is some overlap in our identification process of bubble finding.

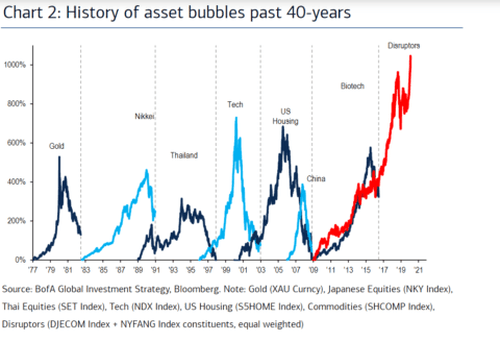

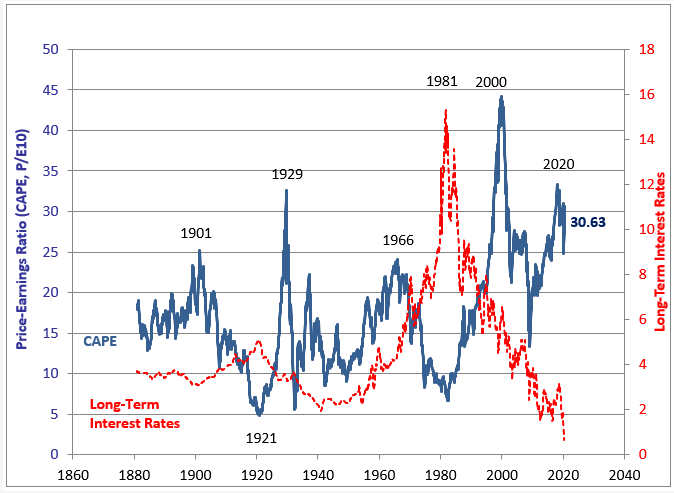

The dotcom bubble is a stock market bubble that was caused by speculation in dotcom or internet-based businesses from 1995 to 2000. This fast inflation is followed by a quick decrease in value or a contra. When investors flock to an asset class such as real estate its demand and price increase.

This myth is dangerous because it is discouraging people from putting money in. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time. That stocks are in a bubble and if you buy now youll lose money.

A bubble is an economic cycle that is characterized by the rapid escalation of market value particularly in the price of assets. A stock market bubble inflates and explodes when investors acting in a herd mentality tend to buy stocks en masse leading to inflated and unrealistically high market prices. Stock market bubbles involve equitiesshares of stocks that rise rapidly in price often out of proportion to their companies fundamental value their earnings assets etc.

They are sometimes referred to as speculative bubbles. An asset bubble is when assets such as housing stocks or gold dramatically rise in price over a short period that is not supported by the value of the product. Thus the fundamental value of the.

Bubbles occur not only in real-world mark. The term is commonly used when talking. The dotcom bubbles origins can be traced to the launch of the World Wide Web in 1989 the subsequent establishment of internet.

Bubbles are sometimes caused by unlikely and overly optimistic projections about the future. They could also be described as prices which strongly exceed the assets intrinsic value. The Financial Times Robert Armstrong doesnt consider that a bubble.

It is caused by a kind of optimism almost irrationally despite the rule of thumb. Instead the bubble sends out a signal that the asset is more valuable than it actually is. These are just standard supply-and-demand reactions in a congested market operating somewhat faster than were.

When they fall they do so quickly and often below the starting value. The hallmark of a bubble is irrational exuberancea phenomenon when everyone is buying up a particular asset. The most common parameter to judge the.

Typically prices rise quickly and significantly growing. Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place. Stock Market Bubble Definition is very simple ie.

Its not always clear what too high means because few people who complain about bubbles bother to explain the basis of a fair valuation but there are some measurements you can take to help you. Generally we think of the value of an asset as a stream of payments in the form of dividends to the owner over time. As you can see a stock market bubble happens when investors are buying stocks neglecting the value of the underlying asset.

Stock market bubble is a term thats used when the market appears exceptionally overvalued driven by a combination of heightened enthusiasm unrealistic expectations and reckless speculation. Theres a dangerous myth going around. The sharp increase in the price of.

The problem with this scenario is that the fundamental value of an asset is not easy to measure. A stock market bubble is a type of economic bubble wherein there will be a spike in asset values within a particular industry commodity or asset class. A stock market bubble is a period of growth in stock prices followed by a fall.

It is caused by exaggerated expectations of. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a. Its a complaint that stock prices are unrealistic based on the value of those stocks.

The crucial nature of a stock market bubble is that trading can go in a direction that is not in your favor. Wikipedia defines a stock market bubble as trade in high volumes at prices that are considerably at variance with intrinsic values Or in plain English asset prices are sky high but people keep jumping on the bandwagon Why they do so is really a question more for psychology than for economics. A stock bubble is a hypothetical lament that stock prices are just too high.

An economic bubble also known as a market bubble or price bubble occurs when securities are traded at prices considerably higher than their intrinsic value followed by a burst or crash when prices tumble. And what exactly is a stock market bubble. When the stock price does not justify the valuation of the stocks.

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

Stock Market Crash Ahead The 2021 Stimulus Bubble 7 Key Bubble Factors Youtube

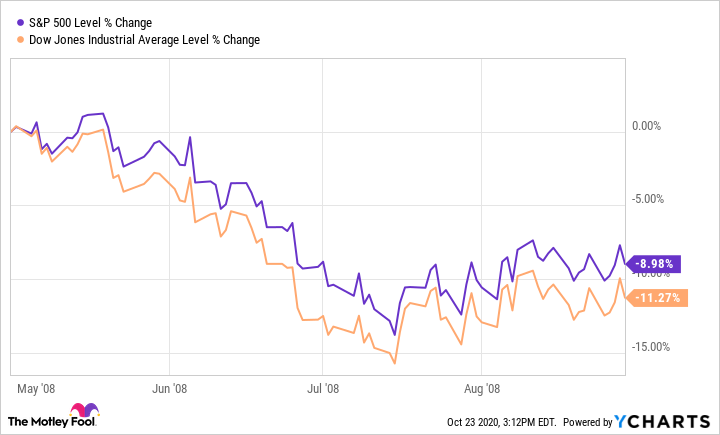

What Are Stock Market Corrections The Motley Fool

What Are Stock Market Corrections The Motley Fool

The Most Hyped Corners Of The Stock Market Come Unglued Wolf Street

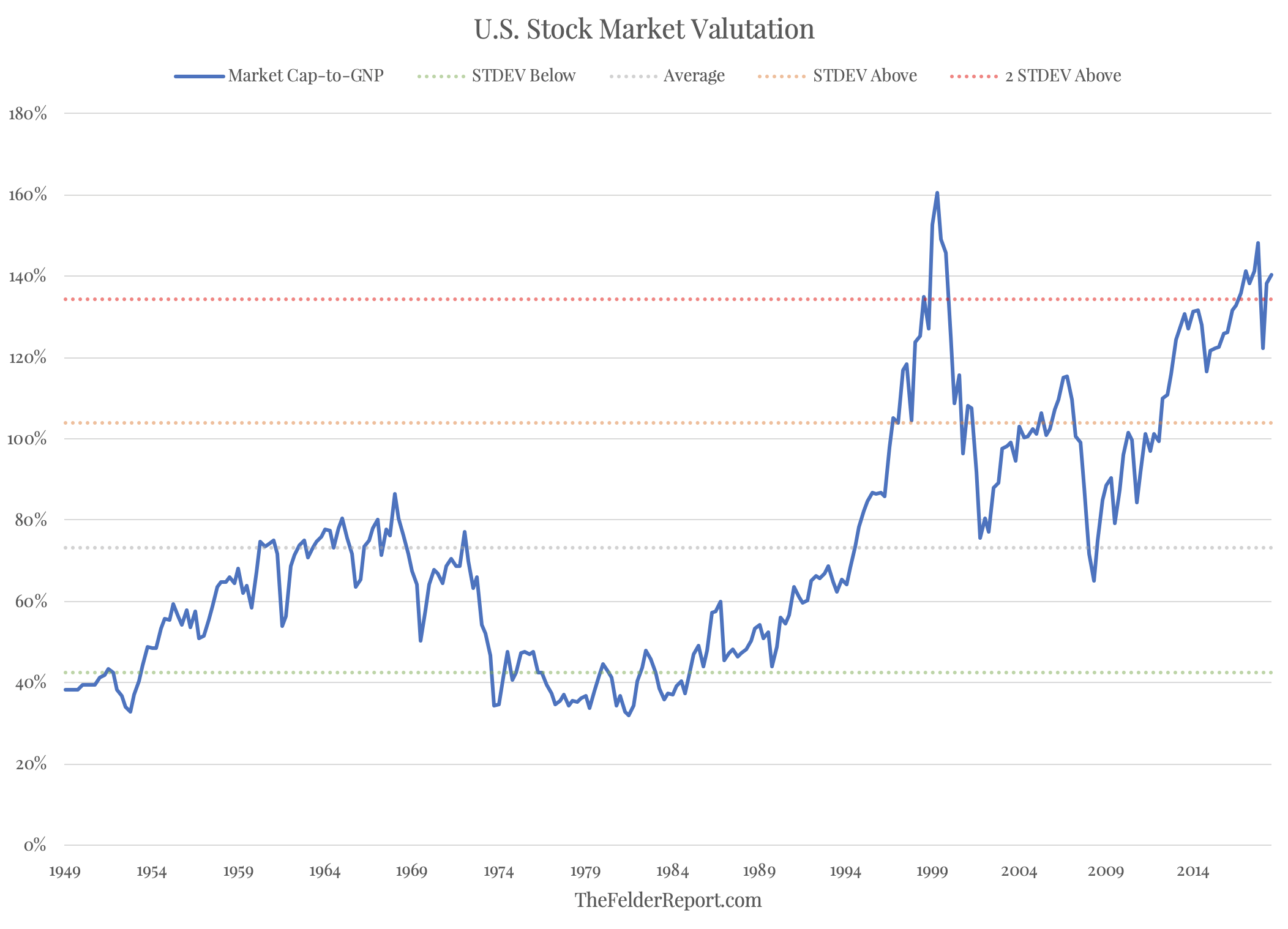

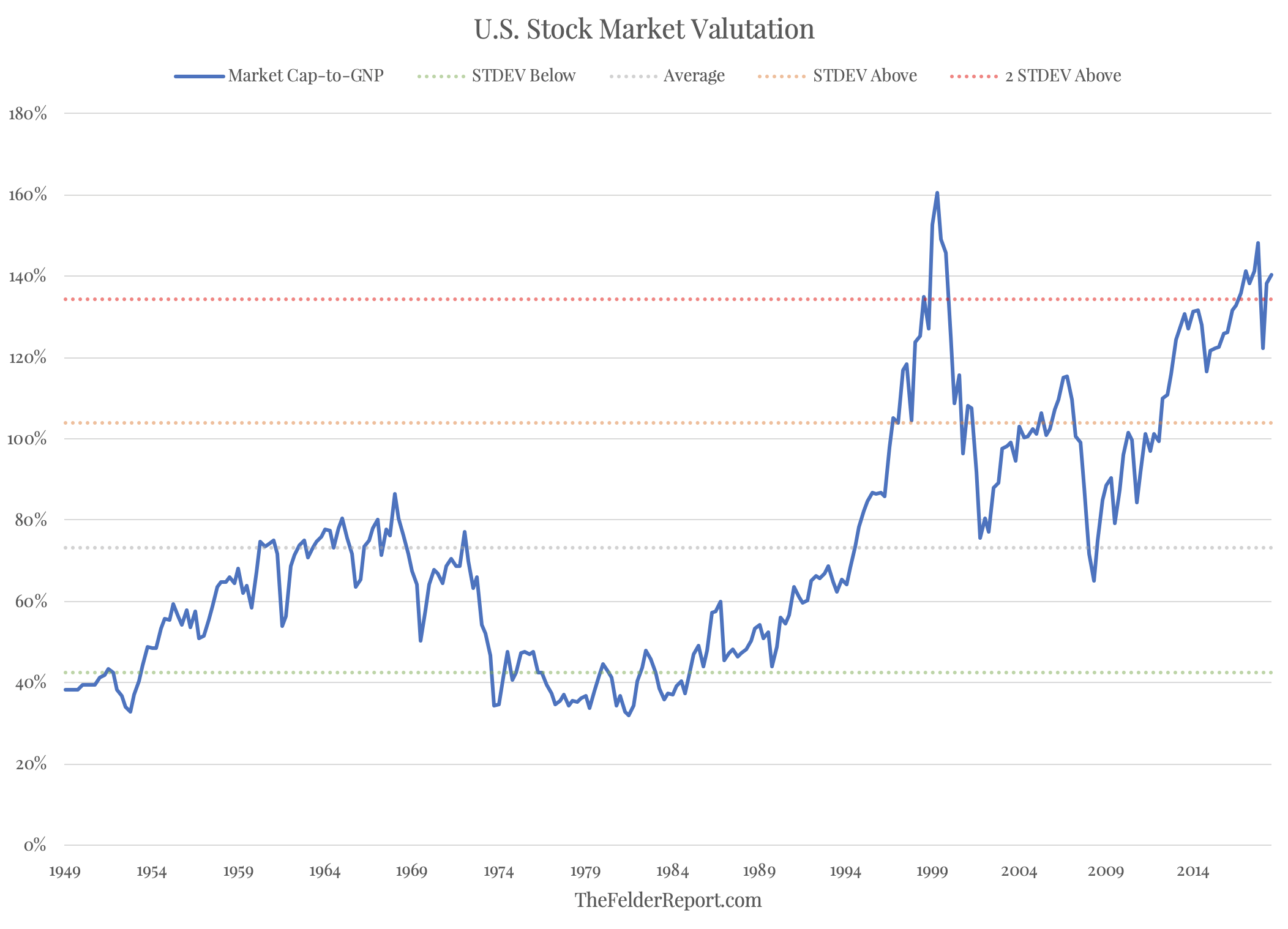

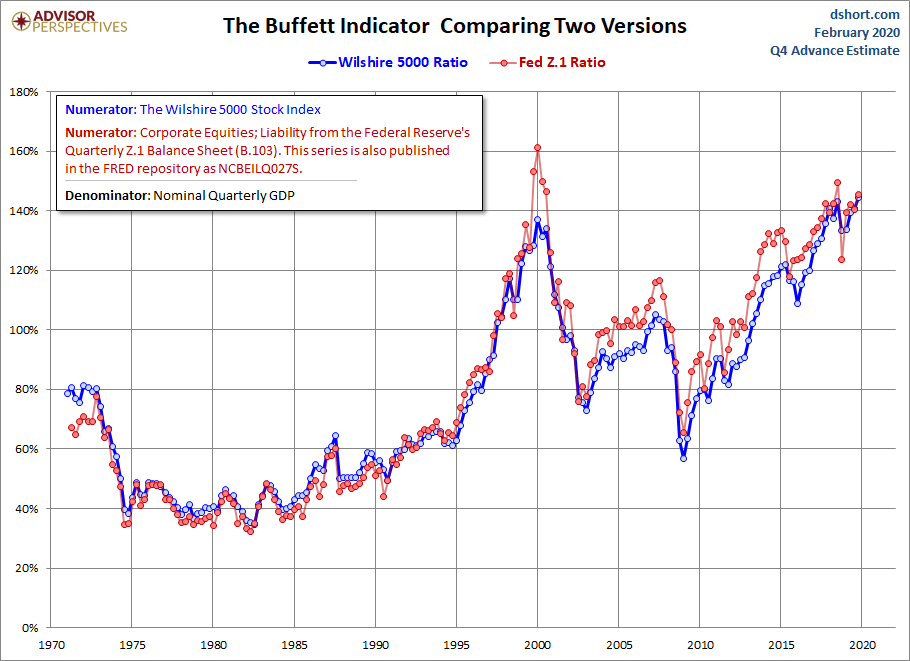

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

Stock Market Rally What Is A Bear Market Rally Vs Bull Market Ig En

How To Identify A Stock Market Bubble 3 Examples Youtube

We Are Now Officially In A Stock Market Bubble Seeking Alpha

Trends In The Stock Market Stock Rotation Ideas Fidelity Stock Market Investment Analysis Marketing Trends

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

We Are Now Officially In A Stock Market Bubble Seeking Alpha

The Enormous Stock Market Bubble And Future Financial And Economic Consequences Seeking Alpha

Covid 19 Lockdowns Recession And A New Stock Market Bubble Real Instituto Elcano

Bull Vs Bear Market What S The Difference The Motley Fool

See How To Identify And Trade Stock Market Bubbles Tradingsim

Stock Market Rally What Is A Bear Market Rally Vs Bull Market Ig En

:max_bytes(150000):strip_icc()/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)